In addition, the company manufactures several hundred of its Spry product, which requires another 2,000 direct labor hours. The controller assigns $160,000 of factory overhead to this product (calculated as 2,000 hours x $80 plantwide rate). Thus, all factory overhead is allocated to the two products using a single plantwide overhead rate.

Simplify Any Calculation With Sourcetable

Ingeneral, the more cost pools used, the more accurate the allocationprocess. The plantwide overhead rate is used to allocate manufacturing overhead costs to products and cost objects, simplifying overhead allocation using a single overhead rate. The Plantwide overhead rate is the overhead rate that companies use to allocate their entire manufacturing overhead costs to their line of products and other cost objects.

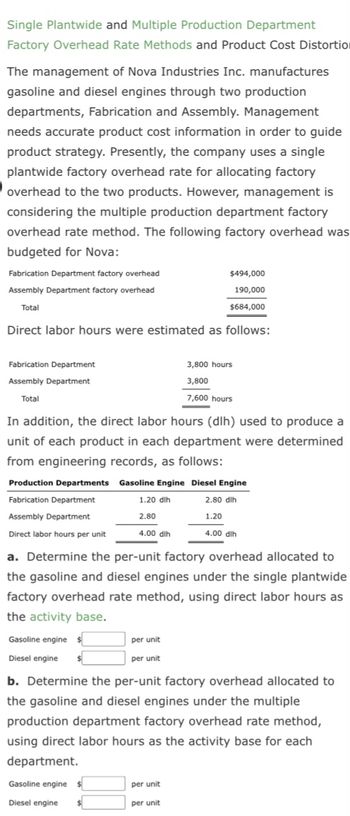

Department Allocation

By accurately attributing overhead costs to products, businesses can price their products more competitively and protect profit margins, particularly in markets with aggressive pricing strategies. By calculating the plantwide overhead rate, firms can improve the accuracy of cost information. This is crucial for competitive pricing and ensuring the company’s profitability, particularly in industries with homogenous products. Retail and construction industries can utilize the plantwide overhead rate to manage diverse and often sizable indirect costs, thus streamlining budgeting and potentially improving financial outcomes.

- In response to this situation, manufacturers will use departmental overhead rates and perhaps activity based costing.

- Thisassumption of a causal relationship is increasingly less realisticas production processes become more complex.

- This approach allows for the use of differentallocation bases for different departments depending on what drivesoverhead costs for each department.

- For example, HewlettPackard’s printer production division may choose tocollect all factory overhead costs in one cost pool and allocatethose costs from the cost pool to each product using onepredetermined overhead rate.

Module 4: Allocating Manufacturing Overhead

This approach allows for the use of differentallocation bases for different departments depending on what drivesoverhead costs for each department. For example, the HullFabrication department at SailRite Company may find that overheadcosts are driven more by the use of machinery than by labor, andtherefore decides to use machine hours as the allocation base. TheAssembly department may find that overhead costs are driven more bylabor activity than by machine use and therefore decides to uselabor hours or labor costs as the allocation base. One more approach is to calculate the plantwide overhead rate using an alternative approach or direct cost method. To calculate this, we first need to identify the total direct cost of production and the total overhead cost for the specific period. Thus, this total overhead is divided by the total direct cost to ascertain the single plantwide overhead rate.

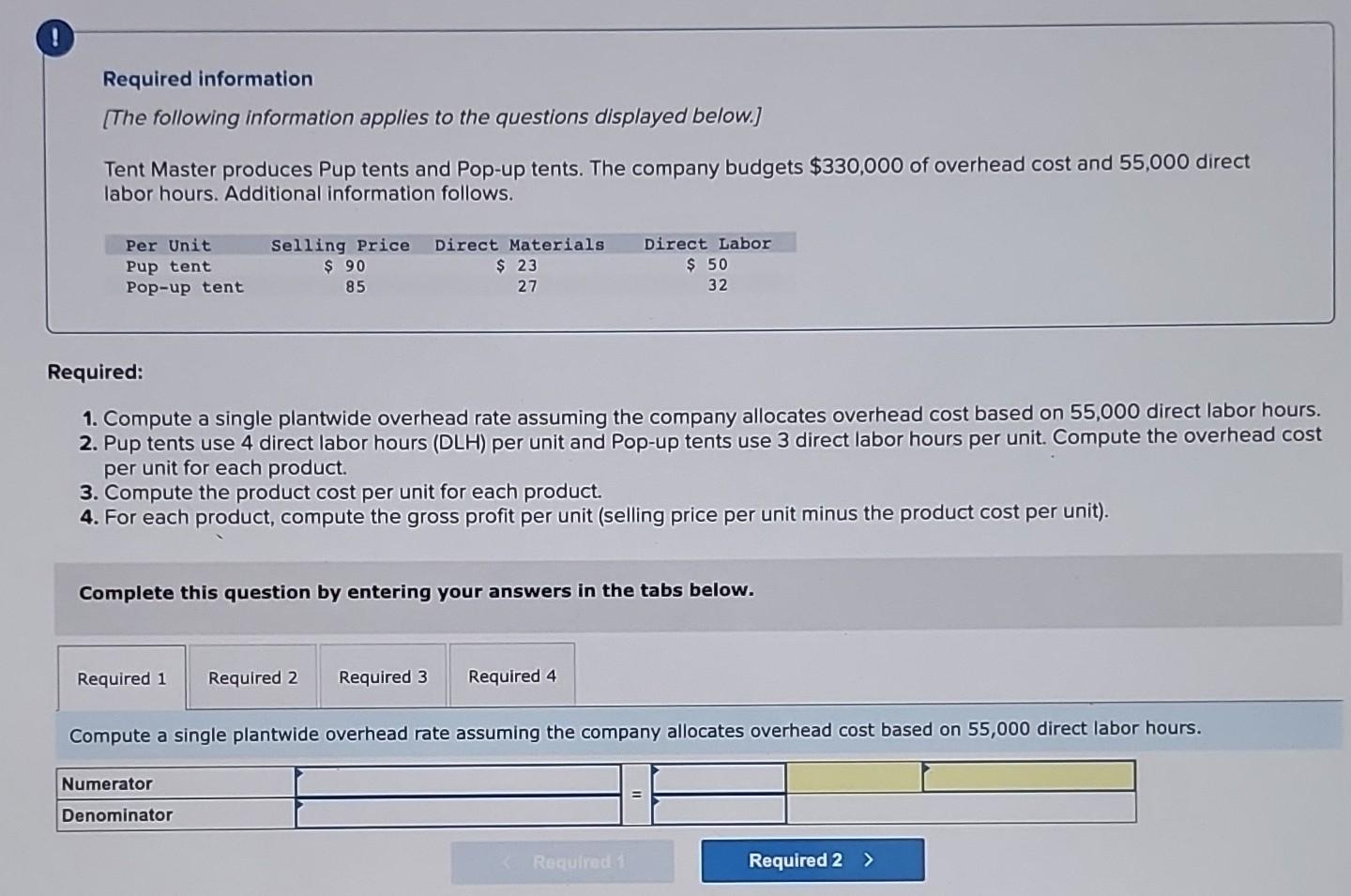

Understanding and calculating the plantwide overhead rate is crucial for businesses aiming to assign manufacturing overhead costs precisely across all units. This calculation aids in determining the cost per unit, aiding in pricing and cost control measures effectively. It involves dividing the total factory overheads by the total number of units produced or the total hours of labor, offering a simpler allocation base compared to departmental overhead rates. Knowing how to calculate the plantwide overhead rate can help optimize production costs and enhance financial accuracy.

Example 4: Seasonal Production Variations

Nimble Corporation uses 10,000 direct labor hours in its main production facility in a typical month. Since the factory has a relatively simple production process, the controller decides to implement a plantwide overhead rate that is allocated based on the number of direct labor hours. Based on the preceding information, the plantwide overhead rate is $80 per direct labor hour. The plantwide overhead rate is a single overhead rate that a company uses to allocate all of its manufacturing overhead costs to products or cost objects. This is a simplified approach to cost allocation that works well in smaller and simpler businesses.

This approach typically provides moreaccurate cost information than simply using one plantwide rate butstill relies on the assumption that overhead costs are driven bydirect labor hours, direct labor costs, or machine hours. Thisassumption of a causal relationship is increasingly less realisticas production processes the main advantage of the plantwide overhead rate method is: become more complex. Understanding how to calculate the plantwide overhead rate is essential for effectively allocating production costs in simpler business structures. This rate simplifies cost allocation by distributing total overhead costs across all units produced, based on labor hours or direct costs.

Assume direct materials cost $1,000 for one unit of theBasic sailboat and $1,300 for the Deluxe. Direct labor costs are$600 for one unit of the Basic sailboat and $750 for the Deluxe.This information, combined with the overhead cost per unit, givesus what we need to determine the product cost per unit for eachmodel. The plantwide overhead rate is best suited for small firms with a simple cost structure, and works well for firms with few products or those producing single products.